IIPM Mumbai Parables - Stories that change life

Though commodities are not safe now, their future looks promising

One

can almost feel the noise and smoke of the scampering steps running for cover from the recent equity meltdown. Barclays Capital’s increased commodities exposure or Goldman Sach’s prophecy – limited damage to commodities from the current credit crunch – might be enough to figure out where the crowd is stampeding. Many consider commodities to be a safe haven at the moment; but is it as safe as many think?

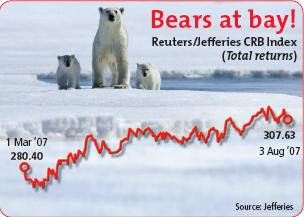

can almost feel the noise and smoke of the scampering steps running for cover from the recent equity meltdown. Barclays Capital’s increased commodities exposure or Goldman Sach’s prophecy – limited damage to commodities from the current credit crunch – might be enough to figure out where the crowd is stampeding. Many consider commodities to be a safe haven at the moment; but is it as safe as many think?Well, first off all looking at the contagion there’s no second opinion that the commodity markets will get affected. Jochen Hitzfeld, Commodities Analyst, UniCredit while talking to B&E opines, “Many of the hedge funds have built up long positions on commodities and with the meltdown taking place, these hedge funds will reverse their positions in search of liquidity which will adversely affect the commodity markets.” The Reuters/Jeffries CRB Index is currently trading 3.69% (August 6, 2007) below July 31, 2007 levels.

Well, it might not be as gloomy as it looks. Firstly, commodities like oil will continue their escalation (refer to the story in the finance section, last issue). Secondly, the future of gold also looks quite bright. With the Federal Reserve expected to cut rates in the near future, there will be an injection of fresh liquidity in the global financial system. This process will see the green back going down which means a green signal for the yellow metal to move up. Finally, the China factor is very much alive and kicking. Consider this – China alone has contributed almost 100% to the total increase in lead and nickel consumption globally. In case of aluminum and steel as well, China has contributed as much as 50% (IMF report) to the total increase in consumption. Well currently, with the dragon economy growing at a stupendous 11.9%, demand for commodities has to move in only one direction – upwards.

As Jochen Hitzfeld puts it, “At this point of time, I believe that it’s a safe strategy to get into commodities.” So, even though the present looks quite shaky on the backdrop of a credit crunch, the future of commodities remains quite stable and upbeat.

For Complete IIPM Article, Click on IIPM Article

Source : IIPM Editorial, 2007

An IIPM and Professor Arindam Chaudhuri (Renowned Management Guru and Economist) Initiative

For More IIPM Info, Visit Below....

The Sunday Indian - India's Greatest News weekly

IIPM International Student Exchange Programme

IIPM, ADMISSIONS FOR NEW DELHI & GURGAON BRANCHES

IIPM, GURGAON

ARINDAM CHAUDHURI’S 4 REASONS WHY YOU SHOULD CHOOSE IIPM...

IIPM Economy Review

IIPM :- Cicero's Challenge is going global

The Indian Institute of Planning and Management (I...

Time for Awards at IIPM

No comments:

Post a Comment